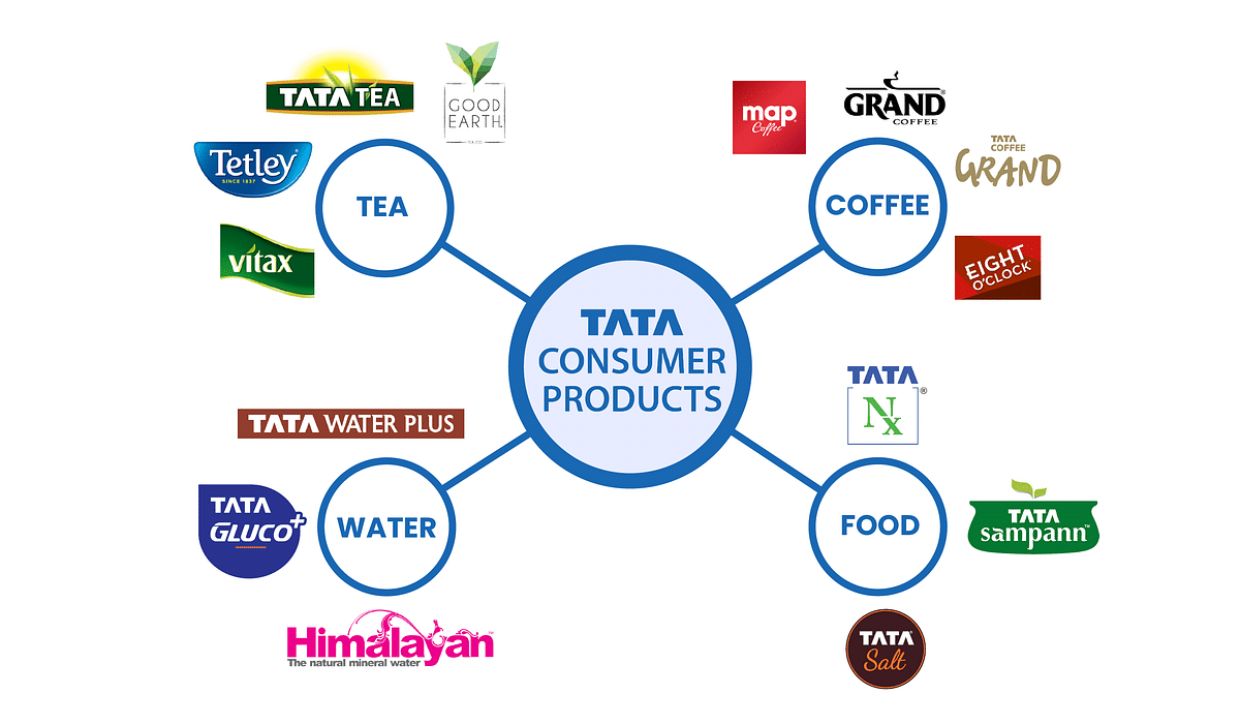

On Monday, October 21, shares of Tata Consumer Products Ltd. dropped by 9%, making them the biggest losers on the Nifty 50 index. This decline followed the company’s September quarter results, which were released after market hours on Friday. It was the largest drop since February 2022, and here are some reasons for the fall:

- The revenue from Tata Consumer's India beverage business fell by 3% compared to last year, with a 4% decrease in sales volume due to low demand. The company also lost 20 basis points in tea market share.

- The ready-to-drink segment saw an 11% revenue drop year-on-year, affected by bad weather and strong competition.

- Although Tata Consumer’s growth business grew by 15% during the quarter, analysts had expected a 30% increase.

- In the Foods division, organic revenue rose by 9%, but volumes only grew by 1%.

- Management noted that the tea business was affected by overall weak market trends, but they are starting to see benefits from their acquisitions of Capital Foods and Organic India.

- On a positive note, Tata Consumer's international business saw margins increase from 10.1% to 15% compared to the same quarter last year.

- The recent acquisitions of Capital Foods and Organic India showed significant growth, with increases of 25% and 45% respectively during the quarter.

ICICI Securities has downgraded Tata Consumer Products' shares from "Buy" to "Add," lowering the price target from ₹1,385 to ₹1,225.

A brokerage has noted that due to high inflation, it has lowered its earnings estimates for Tata Consumer Products for the years 2025 and 2026 by 7% to 8%.

Goldman Sachs has a "neutral" rating on the stock and has reduced its price target to ₹1,050, along with cutting its earnings per share estimates by 10% to 14%.

On the other hand, Morgan Stanley still sees Tata Consumer as a good investment and has given it an "Overweight" rating, but has lowered its price target from ₹1,344 to ₹1,273. They believe focusing on market share rather than margins is crucial for Tata Consumer, especially since demand is slowing down in urban areas while rural demand is slowly improving.

Among the 29 analysts who follow Tata Consumer Products, 22 recommend buying the stock, six suggest holding it, and nine advise selling it.

Currently, shares of Tata Consumer Products are down 9.2%, trading at ₹992.3, making it the biggest loser on the Nifty 50 index. After Monday’s drop, the stock is now negative for the year 2024.

- Tags:

- Latest news

Интеллектуальные поисковые системы для поиска информации становятся всё более удобными. Они дают возможность находить доступные данные из разных источников. Такие боты подходят для аналитики. Они могут оперативно обрабатывать большие объёмы информации. <a href="https://t.me/glasbogamain">telegram bot глаз бога</a> Это способствует сформировать более полную картину событий. Отдельные системы также обладают инструменты фильтрации. Такие сервисы широко используются среди специалистов. Совершенствование технологий превращает поиск информации более точным и быстрым.

Нейросетевые онлайн-сервисы для поиска информации становятся всё более удобными. Они помогают собирать публичные данные из разных источников. Такие боты подходят для аналитики. Они могут оперативно обрабатывать большие объёмы информации. <a href="https://t.me/glasbogamain">глаз богов телеграмм</a> Это помогает создать более полную картину событий. Многие системы также предлагают функции визуализации. Такие сервисы популярны среди специалистов. Развитие технологий позволяет сделать поиск информации эффективным и быстрым.

Нейросетевые поисковые системы для мониторинга источников становятся всё более популярными. Они помогают находить доступные данные из интернета. Такие инструменты применяются для исследований. Они умеют быстро анализировать большие объёмы данных. <a href="https://t.me/glasbogafirst">бесплатный глаз бога @mampmmmr</a> Это способствует создать более точную картину событий. Некоторые системы также предлагают инструменты фильтрации. Такие платформы популярны среди исследователей. Совершенствование технологий позволяет сделать поиск информации более точным и наглядным.

Выбор психолога — ответственный этап на пути к укреплению психологического здоровья. Прежде всего стоит уточнить свои потребности и запросы от сотрудничества с профессионалом. Полезно изучить подготовку и опыт психолога. Комментарии прошлых обратившихся могут поспособствовать сделать решение более обоснованным. https://messiahotyc96306.blog2news.com/37586494/%D0%A1%D0%BF%D0%B5%D1%86%D0%B8%D0%B0%D0%BB%D0%B8%D1%81%D1%82-%D0%B4%D0%B5%D1%82%D1%81%D0%BA%D0%BE%D0%B9-%D0%BF%D1%81%D0%B8%D1%85%D0%B8%D0%B0%D1%82%D1%80%D0%B8%D0%B8-%D0%9C%D0%BE%D1%81%D0%BA%D0%B2%D0%B0-%D0%A6%D0%B5%D0%BD%D1%82%D1%80-%D0%BF%D1%81%D0%B8%D1%85%D0%B8%D1%87%D0%B5%D1%81%D0%BA%D0%BE%D0%B3%D0%BE-%D0%B7%D0%B4%D0%BE%D1%80%D0%BE%D0%B2%D1%8C%D1%8F-%D0%AD%D0%BC%D0%BF%D0%B0%D1%82%D0%B8%D1%8F Также следует учитывать техники, которыми пользуется психолог. Первая встреча помогает понять, насколько есть доверие общения. Необходимо осознавать тариф и способ сотрудничества (например, очно). Правильный выбор специалиста способен улучшить процесс изменений.

Поиск психолога — серьёзный этап на пути к улучшению эмоционального здоровья. Прежде всего стоит уточнить свои задачи и пожелания от консультации с психологом. Хорошо оценить образование и специализацию консультанта. Отзывы других обратившихся могут поспособствовать сделать выбор более уверенным. https://andymbrh21009.wikigiogio.com/1723838/%D0%A1%D0%BF%D0%B5%D1%86%D0%B8%D0%B0%D0%BB%D0%B8%D1%81%D1%82_%D0%B4%D0%B5%D1%82%D1%81%D0%BA%D0%BE%D0%B9_%D0%BF%D1%81%D0%B8%D1%85%D0%B8%D0%B0%D1%82%D1%80%D0%B8%D0%B8_%D0%B2_%D0%9C%D0%BE%D1%81%D0%BA%D0%B2%D0%B5_%D0%9A%D0%BB%D0%B8%D0%BD%D0%B8%D0%BA%D0%B0_%D0%BC%D0%B5%D0%BD%D1%82%D0%B0%D0%BB%D1%8C%D0%BD%D0%BE%D0%B3%D0%BE_%D0%B7%D0%B4%D0%BE%D1%80%D0%BE%D0%B2%D1%8C%D1%8F Также нужно проверить подходы, которыми оперирует консультант. Первая сессия помогает почувствовать, насколько подходит стиль общения. Следует учитывать цену и способ приёма (например, удалённо). Правильный выбор специалиста позволит сделать эффективнее движение к целям.

Этот сайт публикует интересные информационные статьи на любые темы. Здесь доступны новости о политике, науке и многом другом. Информация обновляется ежедневно, что позволяет всегда быть в курсе. Минималистичный дизайн ускоряет поиск. https://miramoda.ru Каждое сообщение написаны грамотно. Целью сайта является достоверности. Читайте нас регулярно, чтобы быть на волне новостей.

Модель Submariner от выпущенная в 1954 году стала первыми водонепроницаемыми часами , выдерживающими глубину до 330 футов. Модель имеет 60-минутную шкалу, Oyster-корпус , обеспечивающие безопасность даже в экстремальных условиях. Конструкция включает светящиеся маркеры, стальной корпус Oystersteel, подчеркивающие функциональность . <a href="https://rolex-submariner-shop.ru">Наручные часы Rolex Submariner фото</a> Механизм с запасом хода до 70 часов сочетается с перманентной работой, что делает их идеальным выбором для активного образа жизни. С момента запуска Submariner стал символом часового искусства, оцениваемым как коллекционеры .

Нужно собрать информацию о человеке ? Этот бот поможет полный профиль в режиме реального времени . Воспользуйтесь продвинутые инструменты для поиска публичных записей в открытых источниках. Выясните контактные данные или интересы через автоматизированный скан с гарантией точности . <a href="https://t.me/GlazBogaFind">глаз бога официальный сайт</a> Бот работает с соблюдением GDPR, обрабатывая общедоступную информацию. Получите детализированную выжимку с геолокационными метками и списком связей. Попробуйте надежному помощнику для исследований — точность гарантирована!

Хотите собрать данные о человеке ? Этот бот поможет детальный отчет в режиме реального времени . Воспользуйтесь уникальные алгоритмы для поиска публичных записей в открытых источниках. Узнайте контактные данные или активность через автоматизированный скан с верификацией результатов. <a href="https://t.me/glasbogaalpha">официальный глаз бога</a> Бот работает в рамках закона , обрабатывая общедоступную информацию. Закажите детализированную выжимку с геолокационными метками и графиками активности . Попробуйте надежному помощнику для исследований — точность гарантирована!

Хотите найти информацию о пользователе? Этот бот предоставит полный профиль мгновенно. Используйте уникальные алгоритмы для поиска цифровых следов в открытых источниках. Узнайте контактные данные или интересы через систему мониторинга с верификацией результатов. <a href="https://t.me/glasbogax">глаз бога телега</a> Бот работает с соблюдением GDPR, обрабатывая открытые данные . Закажите расширенный отчет с геолокационными метками и списком связей. Попробуйте проверенному решению для digital-расследований — точность гарантирована!

Хотите найти данные о человеке ? Этот бот предоставит детальный отчет мгновенно. Используйте продвинутые инструменты для анализа публичных записей в соцсетях . Выясните место работы или интересы через систему мониторинга с гарантией точности . <a href="https://t.me/GlazBogaFind">глаз бога проверка</a> Бот работает с соблюдением GDPR, обрабатывая общедоступную информацию. Закажите детализированную выжимку с историей аккаунтов и списком связей. Доверьтесь проверенному решению для исследований — точность гарантирована!

Септик — это водонепроницаемый резервуар, предназначенная для первичной обработки сточных вод . Принцип действия заключается в том, что жидкость из дома направляется в ёмкость, где формируется слой ила, а жиры и масла собираются в верхнем слое. Основные элементы: входная труба, бетонный резервуар, соединительный канал и дренажное поле для доочистки стоков. https://profconnect.ru/communication/forum/user/46302/ Преимущества: экономичность, минимальное обслуживание и безопасность для окружающей среды при соблюдении норм. Однако важно не перегружать систему , иначе неотделённые примеси попадут в грунт, вызывая загрязнение. Материалы изготовления: бетонные блоки, полиэтиленовые резервуары и композитные баки для индивидуальных нужд.

При выборе компании для квартирного переезда важно проверять её лицензирование и опыт работы . Проверьте отзывы клиентов или рейтинги в интернете, чтобы оценить профессионализм исполнителя. Сравните цены , учитывая расстояние перевозки , сезонность и услуги упаковки. https://ferdinand.com.ua/forum/topics/move-team-uslugi-gruzchikov-v-kieve-i-po-vsej-ukraine.19807/ Убедитесь наличия страхового полиса и запросите детали компенсации в случае повреждений. Обратите внимание уровень сервиса: дружелюбие сотрудников , гибкость графика . Узнайте, используются ли специализированные автомобили и защитные технологии для безопасной транспортировки.

Подбирая компании для квартирного перевозки важно учитывать её наличие страховки и репутацию на рынке. Изучите отзывы клиентов или рейтинги в интернете, чтобы оценить надёжность исполнителя. Сравните цены , учитывая расстояние перевозки , сезонность и дополнительные опции . https://itkr.com.ua/forum/viewtopic.php?t=36502 Убедитесь наличия гарантий сохранности имущества и запросите детали компенсации в случае повреждений. Обратите внимание уровень сервиса: оперативность ответов, гибкость графика . Проверьте, есть ли специализированные грузчики и защитные технологии для безопасной транспортировки.

Dating websites offer a innovative approach to connect people globally, combining intuitive tools like profile galleries and interest-based filters . Key elements include secure messaging , social media integration, and detailed user bios to streamline connections. Smart matching systems analyze preferences to suggest potential partners , while account verification ensure trustworthiness. https://slotdana.biz/dating/psychology-behind-gangbang-fantasies/ Leading apps offer premium subscriptions with exclusive benefits , such as unlimited swipes , alongside real-time notifications . Whether seeking casual chats , these sites adapt to user goals, leveraging AI-driven recommendations to foster meaningful bonds.

Хотите собрать информацию о пользователе? Наш сервис предоставит полный профиль мгновенно. Воспользуйтесь уникальные алгоритмы для поиска публичных записей в открытых источниках. Выясните место работы или интересы через систему мониторинга с верификацией результатов. <a href="https://t.me/GlazBogaFind">пробить через глаз бога</a> Бот работает в рамках закона , используя только открытые данные . Получите расширенный отчет с геолокационными метками и списком связей. Попробуйте проверенному решению для digital-расследований — точность гарантирована!

На этом сайте представлены частные фотографии моделей, отобранные с вниманием к деталям . Здесь можно найти архивные съемки, редкие материалы, тематические подборки для узких интересов. Материалы проверяются перед публикацией, чтобы гарантировать качество и безопасность просмотра. <a href="https://mebelnoe-dvizhenie.ru">drink piss</a> Для удобства пользователей добавлены фильтры по стилю , возрастным группам . Платформа соблюдает конфиденциальность и защиту авторских прав согласно международным нормам .

Хотите найти данные о человеке ? Наш сервис предоставит детальный отчет мгновенно. Используйте уникальные алгоритмы для поиска публичных записей в открытых источниках. Узнайте контактные данные или активность через систему мониторинга с гарантией точности . <a href="https://t.me/GlazBogaFind">глаз бога по номеру телефона</a> Бот работает с соблюдением GDPR, обрабатывая общедоступную информацию. Закажите детализированную выжимку с историей аккаунтов и графиками активности . Попробуйте надежному помощнику для digital-расследований — точность гарантирована!

Нужно найти данные о человеке ? Этот бот поможет полный профиль мгновенно. Воспользуйтесь уникальные алгоритмы для поиска цифровых следов в открытых источниках. Узнайте место работы или интересы через автоматизированный скан с верификацией результатов. <a href="https://t.me/glasbogax">зеркало глаз бога</a> Бот работает с соблюдением GDPR, используя только открытые данные . Закажите детализированную выжимку с геолокационными метками и графиками активности . Доверьтесь надежному помощнику для digital-расследований — результаты вас удивят !

Осознанное участие в азартных развлечениях — это комплекс мер , направленный на предотвращение рисков, включая поддержку уязвимых групп. Сервисы должны внедрять инструменты саморегуляции , такие как лимиты на депозиты , чтобы минимизировать зависимость . Регулярная подготовка персонала помогает реагировать на сигналы тревоги, например, частые крупные ставки. <a href="https://sacramentolife.ru">казино вавада</a> Для игроков доступны консультации экспертов, где можно получить помощь при проблемах с контролем . Соблюдение стандартов включает аудит операций для обеспечения прозрачности. Ключевая цель — создать безопасную среду , где удовольствие сочетается с психологическим состоянием.

Нужно найти данные о человеке ? Наш сервис предоставит полный профиль мгновенно. Воспользуйтесь продвинутые инструменты для анализа публичных записей в открытых источниках. Узнайте контактные данные или активность через автоматизированный скан с верификацией результатов. <a href="https://t.me/GlazBogaFind">глаз бога телеграмм</a> Бот работает с соблюдением GDPR, обрабатывая общедоступную информацию. Закажите расширенный отчет с геолокационными метками и графиками активности . Доверьтесь проверенному решению для digital-расследований — результаты вас удивят !

Наш сервис способен найти данные о любом человеке . Укажите имя, фамилию , чтобы сформировать отчёт. Система анализирует публичные данные и цифровые следы. <a href="https://t.me/GlasBogaMega">глаз бога найти по номеру</a> Результаты формируются мгновенно с фильтрацией мусора. Оптимален для анализа профилей перед важными решениями. Анонимность и актуальность информации — наш приоритет .

Коллекция Nautilus, созданная мастером дизайна Жеральдом Гентой, сочетает элегантность и прекрасное ремесленничество. Модель Nautilus 5711 с самозаводящимся механизмом имеет 45-часовой запас хода и корпус из белого золота. Восьмиугольный безель с округлыми гранями и циферблат с градиентом от синего к черному подчеркивают неповторимость модели. Браслет с H-образными элементами обеспечивает комфорт даже при активном образе жизни. Часы оснащены индикацией числа в позиции 3 часа и сапфировым стеклом. Для сложных модификаций доступны хронограф, вечный календарь и функция Travel Time. <a href="https://patek-philippe-nautilus.ru/">https://patek-philippe-nautilus.ru/</a> Например, модель 5712/1R-001 из розового золота с механизмом на 265 деталей и запасом хода на двое суток. Nautilus остается символом статуса, объединяя инновации и традиции швейцарского часового дела.

Прямо здесь доступен Telegram-бот "Глаз Бога", позволяющий собрать сведения о гражданине из открытых источников. Инструмент работает по ФИО, анализируя публичные материалы в сети. Через бота доступны пять пробивов и детальный анализ по фото. Сервис актуален на август 2024 и включает фото и видео. Бот гарантирует найти профили по госреестрам и предоставит информацию в режиме реального времени. <a href="https://t.me/GlassBogSearch">глаз бога найти по фото</a> Такой бот — идеальное решение в анализе людей через Telegram.

Коллекция Nautilus, созданная Жеральдом Гентой, сочетает элегантность и прекрасное ремесленничество. Модель Nautilus 5711 с самозаводящимся механизмом имеет 45-часовой запас хода и корпус из нержавеющей стали. Восьмиугольный безель с округлыми гранями и циферблат с градиентом от синего к черному подчеркивают уникальность модели. Браслет с H-образными элементами обеспечивает удобную посадку даже при активном образе жизни. Часы оснащены функцией даты в позиции 3 часа и сапфировым стеклом. Для версий с усложнениями доступны секундомер, вечный календарь и функция Travel Time. <a href="https://patek-philippe-nautilus.ru/">Приобрести часы Патек Филип Nautilus здесь</a> Например, модель 5712/1R-001 из розового золота с механизмом на 265 деталей и запасом хода на двое суток. Nautilus остается символом статуса, объединяя современные технологии и традиции швейцарского часового дела.

На данном сайте вы найдете Telegram-бот "Глаз Бога", который проверить данные о гражданине по публичным данным. Инструмент функционирует по номеру телефона, используя доступные данные онлайн. Через бота доступны бесплатный поиск и полный отчет по фото. Инструмент обновлен на август 2024 и поддерживает фото и видео. Глаз Бога поможет узнать данные по госреестрам и покажет результаты мгновенно. <a href="https://t.me/GlassBogSearch">глаз бога программа для поиска людей бесплатно</a> Такой бот — идеальное решение при поиске персон онлайн.

Коллекция Nautilus, созданная мастером дизайна Жеральдом Гентой, сочетает спортивный дух и высокое часовое мастерство. Модель Nautilus 5711 с самозаводящимся механизмом имеет 45-часовой запас хода и корпус из белого золота. Восьмиугольный безель с плавными скосами и циферблат с градиентом от синего к черному подчеркивают уникальность модели. Браслет с H-образными элементами обеспечивает комфорт даже при активном образе жизни. Часы оснащены функцией даты в позиции 3 часа и антибликовым покрытием. Для версий с усложнениями доступны хронограф, вечный календарь и индикация второго часового пояса. <a href="https://patek-philippe-nautilus.ru/">Посмотреть часы Патек Филип Nautilus у еас</a> Например, модель 5712/1R-001 из красного золота 18K с калибром повышенной сложности и запасом хода до 48 часов. Nautilus остается предметом коллекционирования, объединяя инновации и традиции швейцарского часового дела.

Здесь можно получить Telegram-бот "Глаз Бога", который собрать сведения о человеке по публичным данным. Инструмент функционирует по номеру телефона, используя публичные материалы в сети. Через бота осуществляется бесплатный поиск и детальный анализ по запросу. Платфор ма обновлен на август 2024 и охватывает мультимедийные данные. Бот гарантирует узнать данные в открытых базах и предоставит информацию в режиме реального времени. <a href="https://t.me/GlassBogSearch">telegram глаз бога</a> Такой инструмент — помощник при поиске граждан через Telegram.

Монтаж видеокамер поможет контроль помещения круглосуточно. Инновационные решения гарантируют надежный обзор даже в темное время суток. Вы можете заказать множество решений оборудования, идеальных для офиса. <a href="https://videonablyudeniemoskva.ru/">установка наружного видеонаблюдения</a> Грамотная настройка и техническая поддержка делают процесс максимально удобным для всех заказчиков. Обратитесь сегодня, и узнать о лучшее решение в сфере безопасности.

Этот сайт собирает важные инфосообщения в одном месте. Здесь представлены события из жизни, бизнесе и многом другом. Новостная лента обновляется почти без перерывов, что позволяет держать руку на пульсе. Удобная структура делает использование комфортным. https://rftimes.ru Любой материал оформлены качественно. Целью сайта является честной подачи. Следите за обновлениями, чтобы быть на волне новостей.

Наш ресурс собирает интересные информационные статьи разных сфер. Здесь можно найти события из жизни, науке и других областях. Контент пополняется регулярно, что позволяет держать руку на пульсе. Удобная структура ускоряет поиск. https://e-copies.ru Все публикации проходят проверку. Редакция придерживается объективности. Оставайтесь с нами, чтобы быть в курсе самых главных событий.

Данный портал публикует интересные информационные статьи разных сфер. Здесь доступны аналитика, науке и разнообразных темах. Материалы выходят в режиме реального времени, что позволяет держать руку на пульсе. Удобная структура помогает быстро ориентироваться. https://beautydom-salon.ru Любой материал оформлены качественно. Редакция придерживается объективности. Присоединяйтесь к читателям, чтобы быть на волне новостей.

У нас вы можете найти фото и видео для взрослых. Контент подходит для зрелых пользователей. У нас собраны разнообразные материалы. Платформа предлагает четкие фото. <a href="https://casino.ru/bonusy-casino-mostbet/">смотреть порно онлайн без регистрации</a> Вход разрешен только для совершеннолетних. Наслаждайтесь безопасным просмотром.

This website, you can find a wide selection of slot machines from famous studios. Users can experience retro-style games as well as new-generation slots with stunning graphics and interactive gameplay. Even if you're new or a seasoned gamer, there’s always a slot to match your mood. <a href="https://futurefly-whitetiger.com">no depisit bonus</a> All slot machines are available anytime and optimized for PCs and mobile devices alike. All games run in your browser, so you can start playing instantly. The interface is user-friendly, making it convenient to explore new games. Join the fun, and discover the excitement of spinning reels!

Aviator blends air travel with high stakes. Jump into the cockpit and play through turbulent skies for massive payouts. With its vintage-inspired visuals, the game captures the spirit of early aviation. <a href="https://www.linkedin.com/posts/robin-kh-150138202_aviator-game-download-activity-7295792143506321408-81HD/">play aviator game download</a> Watch as the plane takes off – claim before it vanishes to lock in your rewards. Featuring instant gameplay and realistic background music, it’s a top choice for casual players. Whether you're chasing wins, Aviator delivers uninterrupted action with every round.

On this site, you can discover a variety of online casinos. Searching for classic games new slot machines, there’s something to suit all preferences. All featured casinos checked thoroughly for safety, allowing users to gamble with confidence. <a href="https://futurefly-whitetiger.com">vavada</a> Additionally, the platform unique promotions and deals for new players including long-term users. Thanks to user-friendly browsing, finding your favorite casino takes just moments, making it convenient. Be in the know on recent updates through regular check-ins, because updated platforms are added regularly.

访问者请注意,这是一个面向18岁以上人群的内容平台。 进入前请确认您已年满十八岁,并同意了解本站内容性质。 本网站包含限制级信息,请自行判断是否适合进入。 <a href="https://windlounge.de">色情网站</a>。 若不符合年龄要求,请立即关闭窗口。 我们致力于提供优质可靠的网络体验。

欢迎光临 这个平台, 这里有 <a href="https://csgoluck.com/">适合成年人的内容</a>. 成年人喜爱的资源 都可以在这里找到. 这些材料 只为 <a href="https://csgoluck.com/">成年人</a> 打造. 在继续之前 您已年满18岁. 体验独特 <a href="https://csgoluck.com/">成熟内容</a>带来的乐趣吧! 不要错过 属于您的 <a href="https://csgoluck.com/">私人资源</a>. 确保您获得 安全的<a href="https://csgoluck.com/">观看环境</a>.

在此页面,您可以联系专门从事一次性的危险任务的执行者。 我们集合大量技能娴熟的从业人员供您选择。 无论需要何种高风险任务,您都可以方便找到专业的助手。 <a href="https://chinese-hitman-assassin.com">雇佣一名杀手</a> 所有任务完成者均经过背景调查,保证您的机密信息。 任务平台注重专业性,让您的特殊需求更加安心。 如果您需要详细资料,请随时咨询!