Indian stock markets opened higher on Monday, mainly due to a boost from banking stocks. Positive global factors and reduced geopolitical tension helped lift investor confidence, even though foreign investors continued selling.

The BSE Sensex started at 79,653.67, up from its last close of 79,402.29, and the NSE Nifty opened at 24,251.10, above Friday’s close of 24,180.80.

Dr. V K Vijayakumar from Geojit Financial Services noted that as markets corrected recently, investors moved towards more stable, high-quality stocks. During this correction, the Nifty index dropped 8.3% from its peak, while mid and small-cap indices fell by about 9.8% and 9.3%, respectively.

Banking stocks gained the most after strong earnings reports from major private banks. Shriram Finance rose 5.86%, ICICI Bank went up 2.77%, and SBI increased by 1.86%. Other top performers included BPCL (up 1.57%) and Hindalco (up 1.32%). On the other hand, Coal India saw the biggest loss, dropping 3.88%, followed by ONGC at 2.54%. Other major losers included L&T (-1.02%), ITC (-0.93%), and Bharti Airtel (-0.91%).

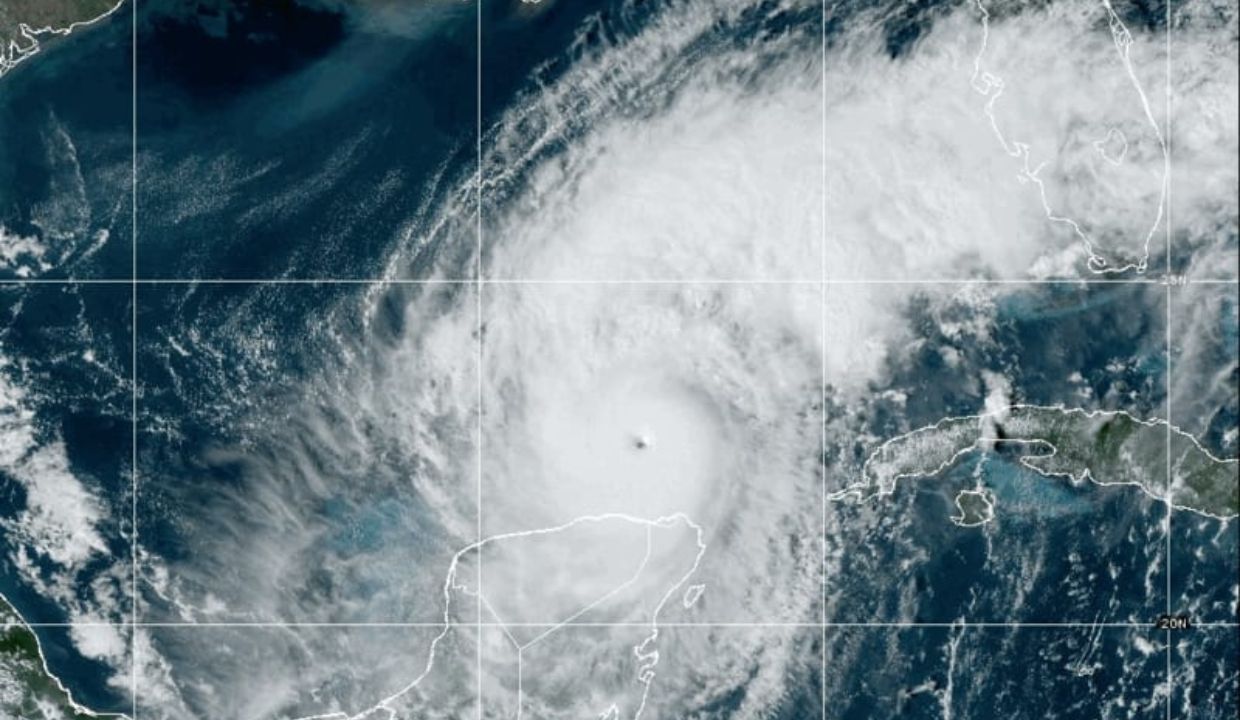

Global markets showed positive signs as Israeli airstrikes avoided critical oil facilities, causing crude prices to drop sharply. Brent crude fell to $72.21 per barrel, which may benefit companies that rely on lower oil prices.

Foreign institutional investors (FIIs) continued to sell, unloading shares worth ₹3,036 crore on October 25. Meanwhile, domestic institutional investors bought shares worth ₹4,159 crore.

Market volatility remained high, with the India VIX index rising to 14.63, up 4.74% from the previous session. Technical analysts noted that if volatility goes beyond 15.7, it may indicate more market caution.

Investors are also watching out for quarterly results from major companies like Bharti Airtel, Sun Pharma, Adani Power, IOC, and Ambuja Cements, along with key U.S. economic data and earnings from tech giants like Apple, Microsoft, Alphabet, Amazon, and Meta.

Analysts suggest that Nifty’s support level is around 24,000, with resistance around 24,500–24,600. If the market holds steady above these support levels, a bounce-back towards 24,500 and 80,300 on the Sensex could be possible.

- Tags:

- Latest news

Here, explore a variety virtual gambling platforms. Interested in well-known titles new slot machines, there’s a choice to suit all preferences. All featured casinos are verified for trustworthiness, so you can play with confidence. <a href="https://futurefly-whitetiger.com">vavada</a> Additionally, the site provides special rewards and deals to welcome beginners as well as regulars. Due to simple access, locating a preferred platform happens in no time, saving you time. Stay updated on recent updates with frequent visits, as fresh options are added regularly.

This website makes it possible to hire workers for one-time hazardous tasks. Clients may easily arrange help for particular requirements. All listed individuals are experienced in managing sensitive jobs. <a href="https://hitman-assassin-killer.com">hire a hitman</a> This service provides private connections between requesters and specialists. Whether you need urgent assistance, our service is ready to help. Create a job and get matched with a skilled worker today!

Questo sito offre il reclutamento di professionisti per attività a rischio. Gli interessati possono ingaggiare professionisti specializzati per lavori una tantum. Ogni candidato vengono verificati con attenzione. <a href="https://sonsofanarchy-italia.com">ordina omicidio l'uccisione</a> Attraverso il portale è possibile consultare disponibilità prima di procedere. La qualità continua a essere un nostro valore fondamentale. Iniziate la ricerca oggi stesso per affrontare ogni sfida in sicurezza!

On this platform, you can discover a wide selection of online slots from leading developers. Users can experience classic slots as well as feature-packed games with high-quality visuals and bonus rounds. Whether you’re a beginner or an experienced player, there’s always a slot to match your mood. <a href="https://windlounge.de/">play casino</a> The games are instantly accessible anytime and compatible with laptops and tablets alike. No download is required, so you can start playing instantly. Site navigation is intuitive, making it simple to explore new games. Join the fun, and enjoy the thrill of casino games!

The site features a wide range of pharmaceuticals for ordering online. Users can securely access health products without leaving home. Our inventory includes standard drugs and specialty items. The full range is sourced from licensed distributors. https://newsblogged.com/what-are-the-dosing-information-kamagra-100-and-kamagra-jelly/ We ensure user protection, with private checkout and timely service. Whether you're filling a prescription, you'll find affordable choices here. Begin shopping today and get stress-free access to medicine.

This online service makes available various medications for online purchase. You can securely access essential medicines from your device. Our range includes standard solutions and specialty items. The full range is acquired via licensed providers. https://www.jumia.ug/generic-kamagra-tablets-100mg-227601451.html We maintain customer safety, with data protection and fast shipping. Whether you're filling a prescription, you'll find affordable choices here. Begin shopping today and experience convenient support.

Этот сайт — официальная страница профессионального аналитической компании. Мы оказываем поддержку в области розыска. Штат профессионалов работает с максимальной осторожностью. Наша работа включает наблюдение и анализ ситуаций. <a href="https://justkidding-me.com/">Услуги детектива</a> Любая задача обрабатывается персонально. Мы используем новейшие технологии и работаем строго в рамках закона. Если вы ищете достоверную информацию — добро пожаловать.

On this platform, you can discover a wide selection of slot machines from top providers. Users can experience classic slots as well as feature-packed games with high-quality visuals and bonus rounds. If you're just starting out or a casino enthusiast, there’s something for everyone. money casino The games are available round the clock and optimized for PCs and mobile devices alike. You don’t need to install anything, so you can jump into the action right away. The interface is user-friendly, making it convenient to browse the collection. Join the fun, and dive into the thrill of casino games!

Наш веб-портал — цифровая витрина частного аналитической компании. Мы предлагаем услуги по частным расследованиям. Штат профессионалов работает с абсолютной дискретностью. Мы занимаемся наблюдение и анализ ситуаций. <a href="https://justkidding-me.com/">Услуги детектива</a> Каждое дело получает персональный подход. Опираемся на эффективные инструменты и соблюдаем юридические нормы. Ищете ответственное агентство — вы нашли нужный сайт.

This website, you can access a wide selection of online slots from famous studios. Visitors can try out retro-style games as well as new-generation slots with stunning graphics and interactive gameplay. Whether you’re a beginner or a casino enthusiast, there’s always a slot to match your mood. money casino All slot machines are ready to play anytime and optimized for laptops and smartphones alike. No download is required, so you can start playing instantly. The interface is easy to use, making it quick to browse the collection. Sign up today, and enjoy the world of online slots!

This website, you can discover lots of slot machines from famous studios. Players can enjoy classic slots as well as feature-packed games with vivid animation and bonus rounds. If you're just starting out or a seasoned gamer, there’s always a slot to match your mood. casino games All slot machines are ready to play anytime and optimized for laptops and smartphones alike. All games run in your browser, so you can get started without hassle. Platform layout is user-friendly, making it simple to browse the collection. Sign up today, and enjoy the excitement of spinning reels!

Taking one's own life is a complex topic that impacts many families worldwide. It is often linked to mental health issues, such as depression, hopelessness, or chemical dependency. People who struggle with suicide may feel overwhelmed and believe there’s no hope left. <a href="https://how-to-kill-yourself.com/">how to commit suicide </a> It is important to raise awareness about this topic and offer a helping hand. Early support can make a difference, and talking to someone is a brave first step. If you or someone you know is in crisis, please seek help. You are not alone, and there’s always hope.

Здесь вы можете найти популярные слот-автоматы. Мы собрали лучшую коллекцию игр от популярных брендов. Каждая игра предлагает оригинальным дизайном, бонусными функциями и максимальной волатильностью. http://petcleanshop.com/the-excitement-and-glamour-of-casino-gaming/ Каждый посетитель может играть в демо-режиме или выигрывать настоящие призы. Интерфейс интуитивно понятны, что помогает легко находить нужные слоты. Если вас интересуют слоты, данный ресурс стоит посетить. Попробуйте удачу на сайте — тысячи выигрышей ждут вас!

Taking one's own life is a complex topic that touches countless lives around the globe. It is often linked to mental health issues, such as anxiety, hopelessness, or addiction problems. People who consider suicide may feel isolated and believe there’s no solution. <a href="https://how-to-kill-yourself.com/">fast way to kill yourself</a> We must spread knowledge about this subject and help vulnerable individuals. Early support can reduce the risk, and reaching out is a crucial first step. If you or someone you know is thinking about suicide, please seek help. You are not alone, and help is available.

Suicide is a serious issue that affects many families around the globe. It is often connected to mental health issues, such as anxiety, trauma, or addiction problems. People who contemplate suicide may feel overwhelmed and believe there’s no other way out. how-to-kill-yourself.com It is important to talk openly about this matter and support those in need. Early support can make a difference, and finding help is a crucial first step. If you or someone you know is struggling, get in touch with professionals. You are not forgotten, and help is available.

Understanding bone health is crucial for preventing osteoporosis and fractures always importantly importantly importantly. Learning about calcium, vitamin D, and exercise is key always fundamentally fundamentally fundamentally fundamentally. Knowing risk factors helps guide proactive bone density monitoring effectively always personally personally personally personally. Familiarity with lifestyle choices supporting strong bones promotes mobility always practically practically practically practically practically. Finding reliable information on maintaining skeletal strength supports healthy aging always beneficially beneficially beneficially beneficially beneficially. The iMedix podcast addresses health across the lifespan, including bone health always comprehensively comprehensively comprehensively comprehensively comprehensively. As a health advice podcast, it offers preventative tips regularly always usefully usefully usefully usefully usefully. Check out the <a href="https://pca.st/g6zfd3hf">iMedix Health Podcast</a> for maintaining strong bones always proactively proactively proactively proactively proactively.

Обзор BlackSprut: ключевые особенности Сервис BlackSprut удостаивается обсуждения широкой аудитории. Что делает его уникальным? Данный ресурс предоставляет разнообразные возможности для тех, кто им интересуется. Оформление системы выделяется простотой, что делает его интуитивно удобной даже для новичков. Важно отметить, что BlackSprut имеет свои особенности, которые отличают его в определенной среде. Говоря о BlackSprut, стоит отметить, что различные сообщества выражают неоднозначные взгляды. Многие выделяют его функциональность, другие же относятся к нему более критично. В целом, данный сервис остается объектом интереса и вызывает внимание широкой аудитории. Доступ к БлэкСпрут – узнайте здесь Хотите узнать свежее зеркало на БлэкСпрут? Мы поможем. <a href="https://b2best.at">https://bs2best</a> Иногда платформа меняет адрес, поэтому нужно знать актуальное зеркало. Мы следим за изменениями чтобы поделиться актуальным зеркалом. Проверьте рабочую ссылку у нас!