The Directorate General of Goods and Services Tax Intelligence (DGGI) has launched a major investigation into a large GST fraud scheme that involves over 200 fake companies across India.

Based on information from the DGGI, the Ahmedabad Crime Branch conducted simultaneous raids at 14 locations, including Ahmedabad, Junagadh, Surat, Kheda, and Bhavnagar. The operation targeted individuals linked to this significant GST fraud, leading to the detention of over 33 key players who are believed to have set up 12 fake companies.

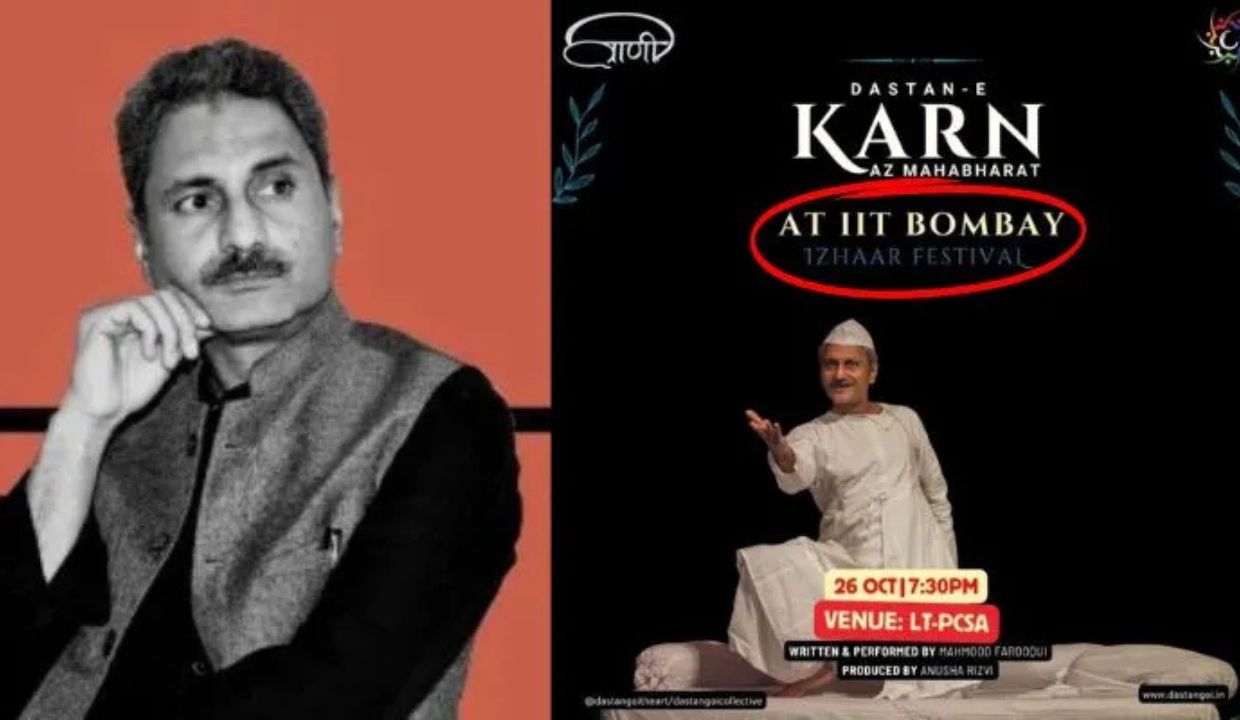

One of those arrested is journalist Mahesh Langa, the son of a well-known MLA from Saurashtra. He was taken into custody based on a complaint from GST authorities, which accused him of using false documents. The Crime Branch is seizing relevant documents and will carry out a detailed investigation.

Sources indicate that the investigation is taking place across 33 locations and focuses on fraudulent Input Tax Credit (ITC) claims amounting to crores of rupees. Authorities have identified several builders and operators connected to the scam. Some of the companies and individuals involved include:

- Arham Steel: Nimesh Vora, Hetalbehan Vora

- Om Construction Company: Rajendrasinh Saravaia, Vanrajsinh Saravaia, Brijrajsinh Saravaia, Hitvarajsinh Saravaia

- Shree Kankeswari Enterprise: Kalubhai Wagh, Prafulbhai Waja, Manan Waja, Jayeshbhai Waja, Vijay Wagh

- Raj Infra: Ratnadeepsinh Dodia, Jayeshkumar Sutaria, Arvinand Sutaria

- Haresh Construction Company: Nilesh Nasit, Jyotish Gondalia, Prabhaben Gondalia

- D.A. Enterprise: Langa Manojkumar Rambhai, Vinubhai Natubhai Patel

- Ethiraj Construction Pvt. Ltd.: Nilesh Nasit, Jyotish Gondalia, Prabhaben Gondalia

- B.J. Odedara: Bhagirath Odedara, Bhojabhai Odedara, Keshubhai Odedara, Bhojabhai Jessabhai Odedara, Abhabhai Jessabhai Odedara

- R.M. Dasa Infrastructure Pvt. Ltd.: Nathabhai Dasa, Ramanbhai Dasa

- Aryan Associates: Ajay Barad, Vijaykumar Barad, Ramesh Kalabhai Barad

- Prithvi Builders: Paresh Pradipbhai Dodhia

- Paresh Pradipbhai Dodia Builders: Paresh Dodia

These individuals are accused of creating shell companies to file fraudulent tax claims and avoid GST payments. The investigation is ongoing, and more arrests are expected as authorities dig deeper into this large-scale financial fraud.

The Ahmedabad Crime Branch's press release stated that there seems to be a well-organized group behind these fraudulent activities, causing significant financial losses to the government through fake billing, forged documents, and misrepresentation. The legal process is underway, and the investigation continues.

- Tags:

- Latest news

https://je-tall-marketing-799.lon1.digitaloceanspaces.com/research/je-marketing-(135).html Try to complement your coloring whereas coordinating with the relaxation of the bridal celebration to some degree.

https://digi631sa.netlify.app/research/digi631sa-(394) You should buy lengthy sleeves, a protracted lace mom of the bride gown, or a stunning ballgown with a boat neckline.

https://classic-blog.udn.com/b1519db7/182779720 It has over a hundred and forty constructive reviews, many from girls who wore this to a marriage and beloved it!

https://marketing-all-business.s3.us-east-005.backblazeb2.com/20250522-25/research/cz-marketing-(174).html This will full your outfit and convey it collectively as an entire.

https://jekyll2.s3.us-west-002.backblazeb2.com/je-20250224-23/research/marketing-(452).html Jovani Plus measurement mother of the bride attire suits any body kind.

https://jekyll2.s3.us-west-002.backblazeb2.com/je-20250331-32/research/marketing-(43).html Similar to the moms of the bride and groom, the grandmothers could wish to coordinate with the marriage party.

Within this platform, find an extensive selection of online casinos. Searching for well-known titles or modern slots, there’s something to suit all preferences. All featured casinos fully reviewed for safety, enabling gamers to bet securely. <a href="https://futurefly-whitetiger.com">casino</a> Moreover, this resource offers exclusive bonuses along with offers targeted at first-timers as well as regulars. Thanks to user-friendly browsing, locating a preferred platform takes just moments, enhancing your experience. Be in the know regarding new entries by visiting frequently, since new casinos appear consistently.

Il nostro servizio consente la selezione di professionisti per incarichi rischiosi. I clienti possono selezionare candidati qualificati per incarichi occasionali. Le persone disponibili vengono verificati con attenzione. <a href="https://sonsofanarchy-italia.com">assumi assassino</a> Attraverso il portale è possibile ottenere informazioni dettagliate prima della selezione. La sicurezza è al centro del nostro servizio. Contattateci oggi stesso per affrontare ogni sfida in sicurezza!

https://digi249sa.netlify.app/research/digi249sa-(399) This sweet and stylish midi with a built-in cape would look just as chic paired with a night shoe as it would with a floor-length maxi.

https://digi328sa.netlify.app/research/digi328sa-(490) I would possibly play a task in my stepdaughter’s wedding ceremony or I won't.

This website, you can access a great variety of online slots from top providers. Visitors can experience classic slots as well as feature-packed games with vivid animation and exciting features. If you're just starting out or a casino enthusiast, there’s something for everyone. <a href="https://windlounge.de/">casino games</a> All slot machines are available anytime and designed for desktop computers and tablets alike. You don’t need to install anything, so you can start playing instantly. The interface is easy to use, making it convenient to explore new games. Sign up today, and enjoy the world of online slots!

This online service offers many types of prescription drugs for online purchase. Users can quickly order treatments from your device. Our catalog includes popular drugs and targeted therapies. The full range is supplied through licensed suppliers. https://www.provenexpert.com/mastoiditis-online/ We prioritize discreet service, with data protection and prompt delivery. Whether you're managing a chronic condition, you'll find trusted options here. Begin shopping today and experience trusted healthcare delivery.

Our platform features a wide range of prescription drugs for ordering online. Users can easily buy treatments from anywhere. Our product list includes everyday solutions and targeted therapies. Each item is acquired via licensed pharmacies. https://www.pinterest.com/pin/879609370963840669/ We prioritize quality and care, with encrypted transactions and prompt delivery. Whether you're looking for daily supplements, you'll find affordable choices here. Explore our selection today and enjoy trusted support.

Наш веб-портал — сайт частного сыскного бюро. Мы организуем поддержку в решении деликатных ситуаций. Штат детективов работает с абсолютной осторожностью. Нам доверяют наблюдение и детальное изучение обстоятельств. <a href="https://justkidding-me.com/">Нанять детектива</a> Любой запрос обрабатывается персонально. Опираемся на эффективные инструменты и ориентируемся на правовые стандарты. Ищете ответственное агентство — свяжитесь с нами.

On this platform, you can find lots of casino slots from leading developers. Users can experience traditional machines as well as feature-packed games with stunning graphics and interactive gameplay. Even if you're new or a casino enthusiast, there’s something for everyone. casino slots The games are instantly accessible round the clock and designed for PCs and tablets alike. You don’t need to install anything, so you can start playing instantly. Platform layout is intuitive, making it quick to browse the collection. Register now, and enjoy the world of online slots!

On this platform, you can discover a wide selection of online slots from top providers. Visitors can experience classic slots as well as new-generation slots with vivid animation and interactive gameplay. Even if you're new or a casino enthusiast, there’s always a slot to match your mood. play casino The games are ready to play 24/7 and optimized for laptops and smartphones alike. All games run in your browser, so you can get started without hassle. Platform layout is user-friendly, making it convenient to browse the collection. Sign up today, and discover the world of online slots!

Данный ресурс — официальная страница профессионального расследовательской службы. Мы предоставляем поддержку в области розыска. Коллектив профессионалов работает с предельной осторожностью. Наша работа включает проверку фактов и выявление рисков. <a href="https://justkidding-me.com/">Детективное агентство</a> Каждое обращение обрабатывается персонально. Опираемся на новейшие технологии и соблюдаем юридические нормы. Нуждаетесь в настоящих профессионалов — вы по адресу.

This website, you can discover a great variety of casino slots from top providers. Players can enjoy traditional machines as well as feature-packed games with vivid animation and exciting features. If you're just starting out or a seasoned gamer, there’s always a slot to match your mood. casino games The games are ready to play round the clock and designed for laptops and smartphones alike. All games run in your browser, so you can jump into the action right away. Site navigation is intuitive, making it convenient to browse the collection. Sign up today, and discover the thrill of casino games!

This website, you can find a great variety of online slots from top providers. Visitors can enjoy retro-style games as well as feature-packed games with vivid animation and exciting features. Even if you're new or an experienced player, there’s a game that fits your style. casino games Each title are ready to play anytime and compatible with desktop computers and mobile devices alike. No download is required, so you can jump into the action right away. Site navigation is intuitive, making it quick to explore new games. Sign up today, and dive into the thrill of casino games!

This website, you can discover a wide selection of casino slots from leading developers. Players can enjoy retro-style games as well as feature-packed games with stunning graphics and interactive gameplay. Whether you’re a beginner or a seasoned gamer, there’s a game that fits your style. casino games Each title are instantly accessible round the clock and compatible with PCs and mobile devices alike. All games run in your browser, so you can get started without hassle. Platform layout is intuitive, making it simple to find your favorite slot. Sign up today, and enjoy the world of online slots!

On this platform, you can find lots of online slots from top providers. Players can enjoy traditional machines as well as modern video slots with stunning graphics and interactive gameplay. Even if you're new or a casino enthusiast, there’s a game that fits your style. slot casino Each title are available anytime and designed for desktop computers and tablets alike. No download is required, so you can get started without hassle. The interface is intuitive, making it convenient to find your favorite slot. Join the fun, and enjoy the thrill of casino games!

На этом сайте представлены различные игровые слоты. Мы предлагаем лучшую коллекцию автоматов от топ-разработчиков. Любой автомат обладает оригинальным дизайном, дополнительными возможностями и высокой отдачей. http://assemble.us/__media__/js/netsoltrademark.php?d=casinoreg.net Вы сможете запускать слоты бесплатно или делать реальные ставки. Меню и структура ресурса интуитивно понятны, что делает поиск игр быстрым. Если вас интересуют слоты, здесь вы точно найдете что-то по душе. Начинайте играть уже сегодня — азарт и удача уже рядом!

Suicide is a complex topic that affects many families across the world. It is often associated with psychological struggles, such as bipolar disorder, stress, or addiction problems. People who struggle with suicide may feel isolated and believe there’s no hope left. https://how-to-kill-yourself.com Society needs to spread knowledge about this topic and support those in need. Early support can make a difference, and talking to someone is a necessary first step. If you or someone you know is thinking about suicide, don’t hesitate to get support. You are not without options, and help is available.

Self-harm leading to death is a serious issue that affects many families around the globe. It is often connected to psychological struggles, such as bipolar disorder, trauma, or substance abuse. People who struggle with suicide may feel overwhelmed and believe there’s no other way out. <a href="https://how-to-kill-yourself.com/">How to kill yourself</a> Society needs to raise awareness about this matter and offer a helping hand. Early support can save lives, and talking to someone is a necessary first step. If you or someone you know is struggling, don’t hesitate to get support. You are not alone, and support exists.

Taking one's own life is a complex topic that touches countless lives across the world. It is often linked to mental health issues, such as bipolar disorder, hopelessness, or addiction problems. People who contemplate suicide may feel overwhelmed and believe there’s no other way out. how-to-kill-yourself.com Society needs to talk openly about this matter and help vulnerable individuals. Prevention can save lives, and reaching out is a crucial first step. If you or someone you know is in crisis, don’t hesitate to get support. You are not without options, and help is available.

На данном сайте можно найти свежие новости Краснодара. Здесь размещены главные новости города, репортажи и важные обновления. Следите за развития событий и читайте информацию из первых рук. Если хотите знать, что происходит в Краснодаре, заглядывайте сюда регулярно! https://krasnodar.rftimes.ru/

Что такое BlackSprut? Сервис BlackSprut вызывает внимание широкой аудитории. Почему о нем говорят? Этот проект обеспечивает широкие возможности для аудитории. Визуальная составляющая платформы характеризуется функциональностью, что делает его интуитивно удобной даже для тех, кто впервые сталкивается с подобными сервисами. Важно отметить, что этот ресурс работает по своим принципам, которые отличают его в своей нише. Говоря о BlackSprut, стоит отметить, что многие пользователи имеют разные мнения о нем. Некоторые выделяют его функциональность, другие же относятся к нему неоднозначно. Таким образом, данный сервис остается темой дискуссий и удерживает заинтересованность широкой аудитории. Ищете актуальное ссылку БлэкСпрут? Если ищете актуальный сайт БлэкСпрут, вы на верном пути. <a href="https://bs2beast.cc">https://bs2best</a> Иногда ресурс перемещается, и тогда нужно знать актуальное зеркало. Обновленный адрес легко найти здесь. Посмотрите актуальную версию сайта у нас!

На этом ресурсе посетители можете найти важной информацией о терапии депрессии у пожилых людей. Здесь собраны советы и описания способов лечения данным состоянием. http://sninternational.in/sn-international-4/